27 Oct UK International Climate Finance Strategy

What is the UK International Climate Finance Strategy?

Climate change is already reshaping lives, economies, and the natural world. Countries that are most vulnerable are suffering first, and many lack the resources to respond. In that context, powerful nations must step forward not only to reduce their own emissions, but also to help others build resilience.

The United Kingdom has made such a commitment: doubling its International Climate Finance (ICF) to £11.6 billion over five years, from 2021/22 to 2025/26, and tripling funding for adaptation to £1.5 billion by 2025. These pledges signal ambition, but their success will depend on delivery, transparency, and sustained impact.

In this article, I explain what the UK’s International Climate Finance Strategy is, why it matters now, how it works, where the risks lie, and how progress might look. My goal is to give you a clear, up-to-date picture of the UK’s climate diplomacy agenda through a sustainability lens.

What Is the Purpose of the Finance Strategy?

The UK International Climate Finance Strategy is the official framework for how the UK supports climate action in developing countries. It outlines priorities, funding commitments, delivery mechanisms, and accountability systems. It aims to help partner nations reduce emissions (mitigation), adapt to unavoidable climate impacts, protect natural assets, and build climate-smart infrastructure.

Historically, the UK pledged to deliver at least £5.8 billion between 2016/17 and 2020/21. Building on that, in 2019 the UK government committed to double that to £11.6 billion by 2025/26, including a dedicated allocation for nature-based solutions (at least £3 billion) and increased support for adaptation. The strategy also emphasizes leveraging private finance, supporting capacity building, and ensuring inclusive delivery.

This strategy frames climate finance as a tool for climate justice and global solidarity. It sees finance not as charity, but as a crucial part of enabling low-carbon development pathways, protecting livelihoods, and managing climate risk in nations already on the frontline.

Why It Matters More in 2025

A Critical Window for Climate Action

The 2020s have been characterized by rapid atmospheric warming, shifting weather extremes, and mounting climate shocks. Every year without decisive emissions cuts narrows the world’s remaining carbon budget. Exceeding 1.5 °C average warming risks crossing tipping points in ice melt, permafrost loss, and ecosystem collapse.

For many developing countries, adaptation is no longer optional,it is essential. Supporting resilience in those places protects lives, economies, and global stability. Financial commitments now help avoid much higher costs later.

Addressing Inequality and Responsibility

The climate crisis is deeply unfair: nations that contributed least to emissions often suffer most. The UK, as a historically major emitter with strong economic capacity, holds a moral and strategic responsibility to support those disproportionately impacted. International climate finance is an expression of that responsibility.

Rebuilding Global Trust and Leadership

In recent years the UK’s foreign aid budget has faced cuts and political scrutiny. Fulfilling the ICF pledges is essential not just for climate goals, but for restoring credibility in global climate negotiations. Observers have flagged risks in how the UK counts its climate finance (e.g. over-reliance on reclassified aid).

If the UK delivers robust, transparent climate finance, it can help catalyze greater ambition from other countries and strengthen multilateral climate cooperation.

Core Pillars of the Strategy

The UK’s ICF Strategy is built around four thematic pillars:

Clean Energy and Decarbonization: The UK supports partner countries to shift away from fossil fuels, scale renewable energy, and improve energy efficiency. The strategy emphasizes that access to reliable clean energy is essential for equitable development and emission reduction.

Nature for Climate and People: Nature-based solutions are central. Investments will support forest restoration, sustainable land use, peatland protection, and integrated ecosystems management. These interventions enhance biodiversity, store carbon, and support livelihoods.

Adaptation and Resilience: Many climate impacts are already underway. UK funding aims to strengthen resilience in agriculture, water systems, coastal zones, disaster risk planning, and climate-smart infrastructure in vulnerable communities.

Sustainable Cities, Infrastructure, and Transport: With urbanization accelerating globally, green infrastructure is vital. The strategy supports low-carbon transport, climate-resilient building design, sustainable waste systems, and inclusive urban planning.

The balance between mitigation and adaptation funding is intended to reflect urgency in emerging economies while protecting those with the least capacity to cope.

How the Strategy Works in Practice

Public Finance Meets Private Investment

UK climate finance is not simply grants. The strategy uses public capital strategically to mobilize private investment. Instruments may include blended finance, guarantees, concessional loans, and investment partnerships (such as British Investment Partnerships, or BIP). Public funding helps reduce risk and attract larger private flows.

Partnerships and Delivery Channels

Funds flow through multilateral institutions, bilateral programs, development banks, civil society, and green investment vehicles. The UK emphasizes collaboration with institutions such as the Green Climate Fund, the World Bank, and regional development banks, while also scaling direct bilateral assistance.

Monitoring, Reporting, and Accountability

To maintain credibility, the strategy emphasizes robust monitoring and evaluation. Clear indicators, performance reviews, and annual reporting are part of the framework. Stakeholder feedback mechanisms are expected to ensure relevance to local communities and course correction where needed.

Geographic and Thematic Targeting

The strategy prioritizes climate-vulnerable countries, regions with high biodiversity, and places with high potential for clean energy growth. It also pushes for gender-responsive approaches, inclusion of marginalized groups, and alignment with local climate and development plans.

Progress, Risks, and Critiques

Current Progress

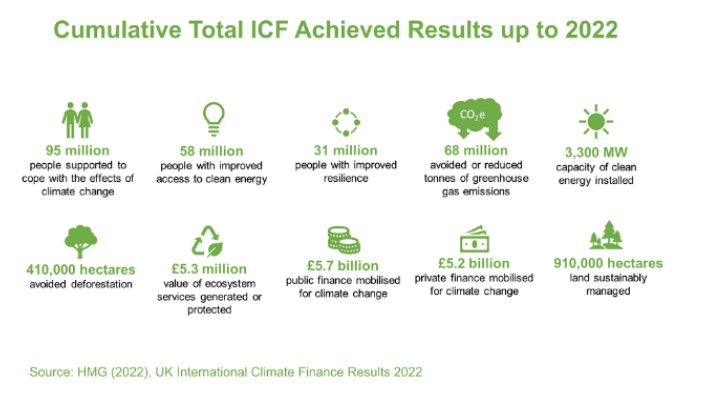

Recent reporting and data suggest the UK is on track to meet its ICF goal, though with notable caveats. In the financial year 2024–25, climate finance reached nearly £3 billion, much higher than prior years. However, critics argue that accounting changes and reclassifying existing aid may inflate numbers without providing equivalent new funding.

Multilateral commitments and strengthened bilateral allocations offer hope that funds can reach on-the-ground climate action, particularly in Asia and Africa.

Risks and Criticisms

Several challenges could undermine impact:

- Double counting or reclassification of aid: Some reports suggest that up to £500 million of aid was recategorized as climate finance without clear climate linkages.

- Backloading of expenditures: More than half of the £11.6 billion is scheduled for disbursement in the final two years, creating pressure and risk of shortfalls.

- Limited mitigation effect relative to scale: From 2011 to 2024, UK climate finance may have mitigated only a fraction of global emissions growth. Some analysts regard its cost per tonne as high relative to other tools.

- Capacity and absorptive constraints: Recipient countries may lack institutional, technical, or governance capacity to deploy funds effectively.

- Political and fiscal pressures: Domestic budget constraints, shifting priorities, and changes in government could weaken commitment or redirect funds.

What Success Looks Like by 2030

If the UK International Climate Finance Strategy is delivered with focus and integrity, the next five years could mark a defining shift in how international partnerships confront the climate crisis. By 2030, the tangible results of this strategy could reshape lives, economies, and ecosystems across the world.

A central outcome would be universal access to clean, reliable energy in developing nations, especially across Africa and South Asia. Millions of households currently dependent on kerosene, diesel, or firewood could gain electricity from renewable sources such as solar mini-grids and wind farms. This shift would not only lower emissions but also expand education, healthcare, and local entrepreneurship. When communities have consistent power, they gain the tools to grow and innovate sustainably.

Deforestation and ecosystem degradation could fall sharply, as nature-based solutions begin to take root. Projects funded under the UK ICF would protect tropical forests, restore mangroves, and rehabilitate degraded lands. These landscapes act as carbon sinks, support biodiversity, and provide essential ecosystem services like clean water and soil fertility. By helping communities manage these natural assets, the UK’s funding could strengthen rural economies while preserving the environmental balance.

Another major marker of success would be enhanced climate resilience in vulnerable regions. Across small island states, flood-prone river basins, and drought-affected farmlands, people could have better early warning systems, improved water management, and stronger local infrastructure. The goal is not only to help countries recover from disasters but to build capacity that prevents crises from escalating in the first place.

Urban centers could also undergo transformation. Climate-smart infrastructure — including energy-efficient housing, electric public transport, and green urban spaces — could redefine how cities grow. Reduced heat stress, better air quality, and inclusive public services would make these cities healthier and more livable, while contributing to global emission cuts.

Beyond direct development outcomes, success would mean mobilizing private investment at scale. By blending public and private finance, the UK could help unlock billions in green capital, channeling it into clean energy, sustainable agriculture, and circular economy ventures. Each pound of public investment could attract several more from businesses, banks, and institutional investors, multiplying its impact.

Finally, the UK’s leadership could establish a culture of accountability and transparency in climate finance. Clear reporting, independent evaluation, and feedback mechanisms would ensure funds deliver measurable results. This continuous learning approach would help refine project design, avoid duplication, and maximize the value of every investment.

Together, these outcomes would represent more than financial achievement. They would demonstrate how international climate finance can transform economies while protecting the planet. If the UK succeeds in meeting its ICF goals by 2030, it will not only validate its pledge but also strengthen global confidence that sustainable, low-carbon, and equitable growth is achievable, and that cooperation, when backed by action, can change the course of our shared future.

About SOStainability

At SOStainability, we specialize in guiding businesses, communities, and organizations to successfully integrate sustainability into their strategies. We offer consultations tailored to your unique needs, helping you drive positive change that benefits both your bottom line and the world around you.

Whether you’re looking for sustainability assessments, ethical marketing strategies, or tailored training, our team is here to support your journey.

For consultations or business inquiries, please reach out to us at hello@sostainability.co.uk

No Comments